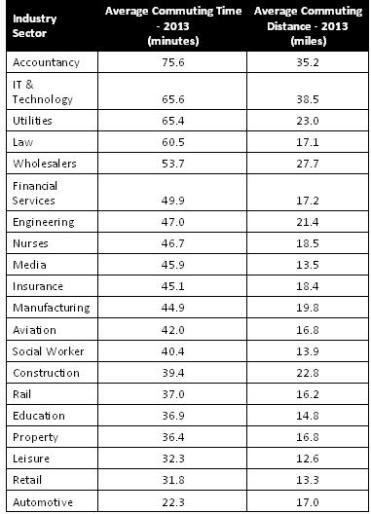

People working in insurance have the most opportunities for promotion in the UK when it comes to their career progression according to research by recruiter Randstad.

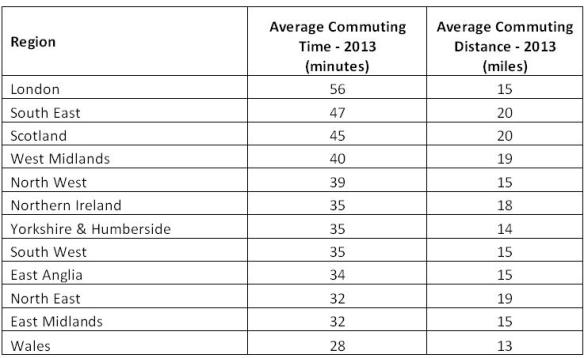

In a survey of over 2,000 British workers, 38% of British workers said they were content with their career progression. But 73% of those working in insurance said they were happy with the way they were scaling the corporate ladder. Those working in property, financial services, nursing, IT and telecoms, and education were also above average.

At the other end of the spectrum, those working in media and wholesale were the least happy with their career progression (12% and 13% respectively).

WHERE ARE YOU ON THE CAREER PROSPECTS LEAGUE?

|

INDUSTRY SECTOR

|

I am Happy With My Career Progression

|

|

Insurance

|

73%

|

|

Property

|

59%

|

|

Law

|

55%

|

|

Financial Services

|

46%

|

|

Leisure

|

41%

|

|

Health (e.g. Nurse)

|

40%

|

|

IT & Telecoms

|

39%

|

|

Education

|

38%

|

|

UK AVERAGE

|

38%

|

|

Rail

|

37%

|

|

Engineering

|

36%

|

|

Social Care (e.g. Social Work)

|

34%

|

|

Retail

|

33%

|

|

Accountancy

|

26%

|

|

Wholesalers

|

13%

|

|

Media

|

12%

|

“Career Blockers” Cutting Down High-Flyers’ Promotions Prospects

The variations between sectors may be explained by how talent is managed across different industries. Organisations that manage their employees’ careers most effectively adopt “up or out” policies that require the dismissal of employees who fail to attain a promotion after a certain amount of time – ensuring high flyers’ promotions aren’t held up by “career blockers”. The United States Armed Forces, for instance, require that certain ranks be held for no longer than a set amount of time, a lack of compliance with which could render grounds for dismissal.

In the UK, leading insurance, financial services and law firms have adopted this ‘Up or out’ American model. And these were three of the sectors in which people are most happy with their career progression.

Mark Bull, CEO of Randstad UK says, “Dynamism in the workforce creates a high performance culture and is fundamental for the success of employers and the happiness of employees. But there could be ‘career blockers’ holding up the promotion prospects of good employees in sectors like media and wholesaling. That’s frustrating for those high-fliers who are left with no way to climb past underperforming managers. Increasingly we see them looking elsewhere.”

Promotion Schedules Halted in Recession

Frustration with career progression in sectors like media and wholesale may also be explained by organisations’ reactions to the recession. The economic downturn has led to some employers abandoning promotion schedules – assuming that the mere existence of a job should be enough to keep and motivate existing staff. Randstad’s latest World of Work survey found that more than 60% of UK workers have taken on extra responsibilities as a result of the crisis – without being compensated for the additional demands.

Mark Bull explains, “Employers had to make difficult choices when deciding where and how to reduce costs in response to falling markets. Slowing down promotions may have been the obvious choice in the short-term. However with the focus on cutting employee numbers, it’s easy to forget about the people left behind. If this was a conventional downturn, most employees would have accepted the lack of promotions as a temporary setback or the price of protecting their job in difficult times. But this isn’t a temporary downturn and as a result, the UK is left with a talent time-bomb – a bomb that’s likely to go off as alternative jobs become available. Among the top 15% of the workforce, outside of sectors like financial services and insurance, three in every five employees say they aren’t happy with their career progression. If companies aren’t forward thinking in their talent management they will see their top 15% go elsewhere.”

While many business leaders are aware their organisations are at risk of losing their top performers if they cannot find ways to progress their careers appropriately, career management is often not easy. Career discussions can be interrupted by the day-to-day pressures of the working environment and managers can face a conflict between the need to manage their teams in the short-term while balancing long-term career prospects.

Mark Bull comments, “Employers should obviously be looking after the most productive top 15% of their workforce, but they also need to motivate other staff who may have become disenchanted with poor promotion prospects. High-flyers, for instance, may feel they are being forced to carry under-performing colleagues. Employers need to take and active approach to managing engagement within their organisation. Issues raised in staff satisfaction surveys must be addressed. Line management also has a crucial role in sustaining motivation and indentifying people who have become disengaged through the appraisal process and in day-to-day management. Finding new challenges for dissatisfied people or better recognition and development of their skills could not only improve their performance, but also strengthen engagement and productivity as a whole.”

Career Progression Doesn’t Always Go Hand In Hand with Headcount Growth

Additionally there appears to be little relationship between headcount growth and how satisfied people are with their career progression, again suggesting employers could relook at how they manage talent within their organisation. While, the sector which expanded the most between 2009 and 2012 was IT & Telecommunications (in 2012 there were 44% more people working in IT and Telecoms than in 2009 according to the ONS) employees were only marginally happier than the rest of the country’s workforce. The number of people with permanent jobs in nursing expanded by the second largest proportion (26%) – but nurses were also only slightly happier than average with their career progression. Over the same period, the UK’s permanent workforce expanded by 10%. Insurance – the sector in which people were most happy with their career progression – didn’t expand between 2009 and 2012 and the property sector, which had the second highest percentage of employees happy with their career progression, grew by just 1%.

Mark Bull admits: “We expected to find a relationship at some level between career progression in a sector and job growth. But the figures don’t bear this out. Insurance remained static in size as a sector between 2009 and 2012, and the property sector expanded by just 1%, but these were the two sectors in which people were most happy with their career progression. We think this points to pride in being part of a high performance culture with sophisticated application of talent management.”

What Does Career Progression Mean To People Today?

In further research carried out by Randstad, when asked to think back twelve years and remember what they thought the most important elements of career progression were, 62% of respondents said better pay, making it the most important factor. However, when asked what they thought the most important elements of career progression were today, the most popular factor was Doing work that lets me learn new things, meet new people and participate in different projects – an option chosen by 74% of respondents.

Mark Bull added, “Employees are redefining the meaning of career progression. When it comes to career progression, not only are the values people hold changing, the whole concept of a career as an upward progression through a sequence of roles in one firm has changed. Flexibility in the workforce means that for many a career doesn’t involve progression: it may be a series of moves that go sideways, or even backwards, and cross occupational and organisational boundaries for others its simply increasing their skill sets.”